free cash flow yield calculator

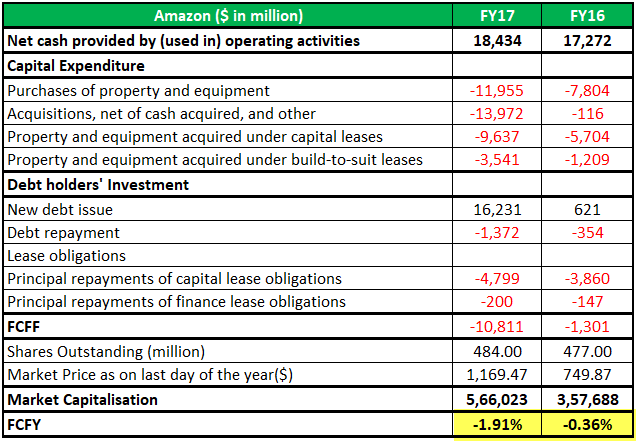

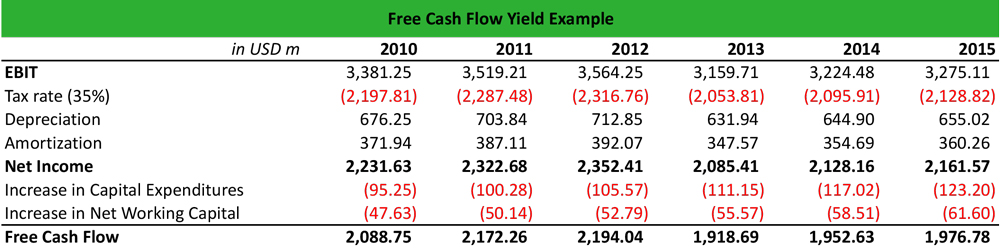

Hence Free cash flow available to the firm for the calendar year is. To understand it we will use a hypothetical example and calculate the free cash flow for an.

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

Ad Calculate the impact of dividend growth and reinvestment.

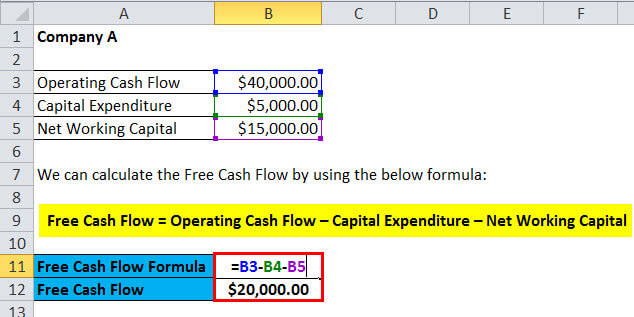

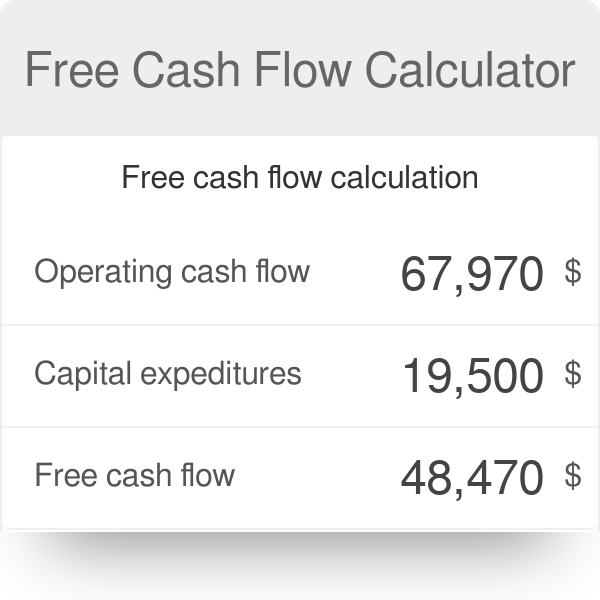

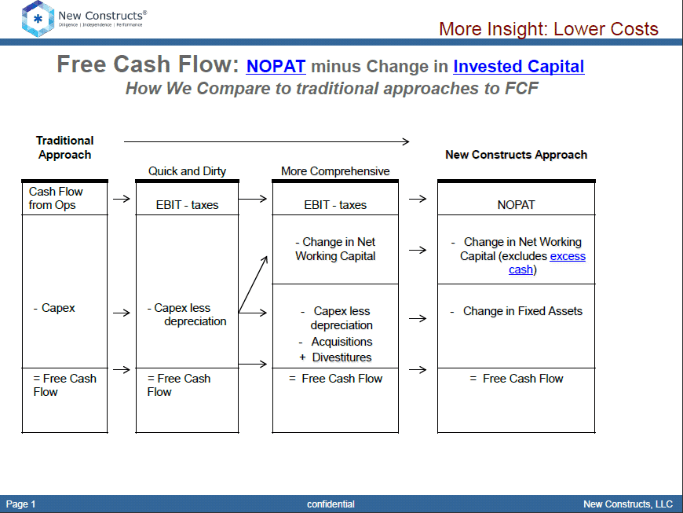

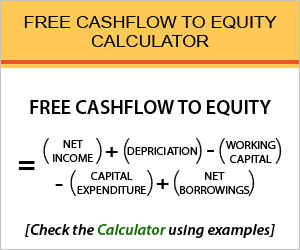

. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures. Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital.

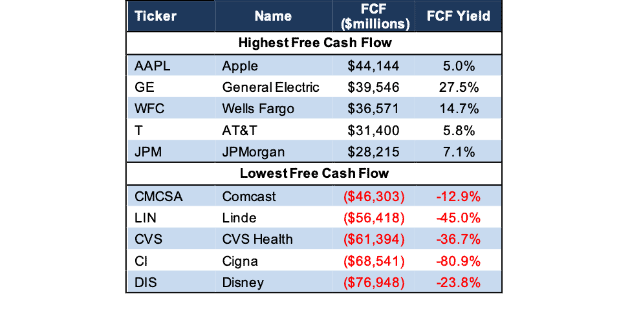

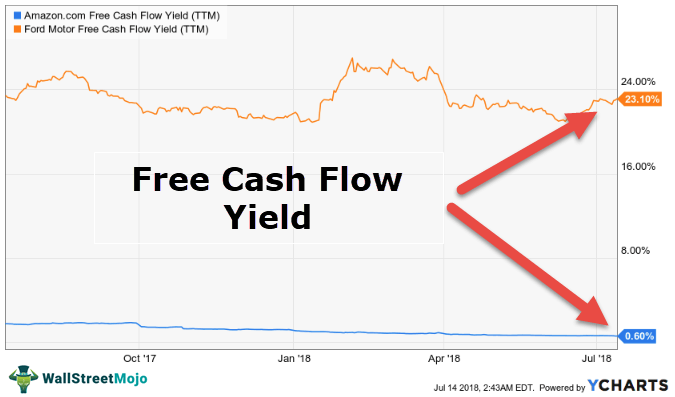

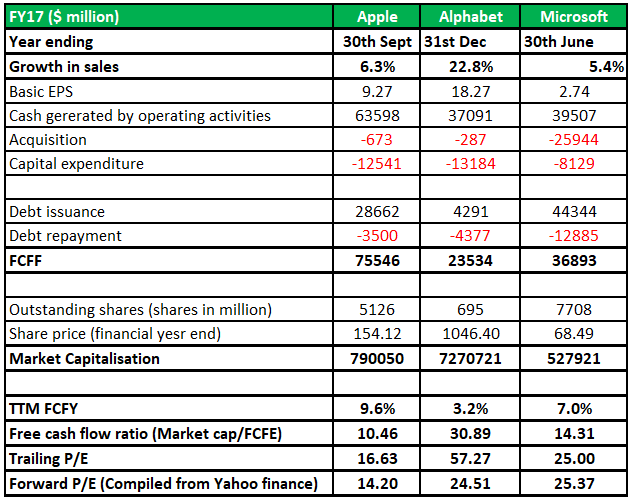

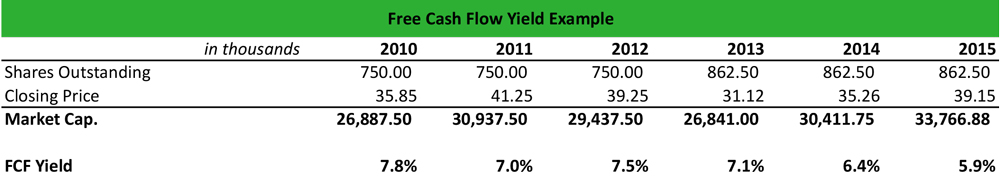

Free Cash Flow Supports Regular Dividend Payments. Free cash flow yield is really just the companys free cash flow divided by its market value. The formula for calculating free cash flow FCF per share.

Generally you compute it using the cash flow per share and the. Free cash flow FCF is more valuable than the net profit PAT of a company. Calculate your cashflow and return on investment period by entering your property price monthly rent annual.

What is the Cash Flow Yield. Ad QuickBooks Financial Software. To break it down free cash flow yield is determined first by using a companys.

You can calculate the free cash flow yield by dividing the free cash flow FCF by the market capitalization. Get paid faster with electronic invoicing and automated follow-ups. In practical terms it would not make sense to calculate FCF all in one formula.

Free Cash Flow Yield between 10 and 20. Cash flow yield is the percentage of cash flow a company generates based upon the price paid. If the free cash flow of the company is decreased and if the company is investing in its growth that is also not bad for the company.

Free Cash Flow Yield between 10 and 20. Substituting cash flow for time period n CFn for FV interest rate for the same period i n we calculate present value for the cash flow for that one period PVn P V n C F n 1 i n n. VF Corporation has increased its regular dividend from 194share in fiscal 2019 fiscal year end was 33019 to.

Rated the 1 Accounting Solution. Free Cash Flow Yield. Get the tools used by smart 2 investors.

Free Rental Yield Calculator. The FCF is the cash thats available to shareholders after the company has paid. Get Started With Our Rental Yield Calculator.

We Manage Receivables Payables To Streamline Processes Grow Your Business. Ad Customized Cash Flow Management Solutions From MT Bank. Ad Generate clear dynamic statements and get your reports the way you like them.

Figure 1 shows trailing FCF yield for the Energy sector rose from 07 as of 63021 to 40 as of 51622. The Energy sector FCF rose from 168 billion in 1Q21 to 1232. Free Cash Flow 550 million 100.

We will see how.

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Free Cash Flow Fcf In Financial Analysis Magnimetrics

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow And Fcf Yield New Constructs

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Calculator Free Cash Flow

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

Free Cash Flow Formula Calculator Excel Template

What Is Free Cash Flow Yield Definition Meaning Example

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Free Cash Flow And Fcf Yield New Constructs

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield Definition Meaning Example

Free Cashflow To Equity Calculator Formula Check Example More

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template