ct tax sales calculator

The tax rate of. The gross sales amount will be 52500 divided by 107 or 49065.

States With The Highest And Lowest Sales Taxes

500000 Last Sold Price.

. Tax Exemption Programs for Nonprofit Organizations. The base state sales tax rate in Connecticut is 635. Marginal tax rate 22.

Click here to view the Tax Calculators now. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Connecticut local counties cities and special taxation. 6 for up to 200000.

Exemptions from Sales and Use Taxes. Local tax rates in Connecticut range from 635 making the sales tax range in Connecticut 635. The calculator will show you the total.

How do you calculate sales tax on a calculator. The sales tax rate for the Connecticut state is 635 for the year 2021. SOLD MAY 20 2022.

If you are single or married and filing separately the tax rate is 3 for those who make 10000 or less in taxable income. The Connecticut State Conveyance tax rate is 075 for the first 800000 of the selling price of the property and any amount between 800000-25M is taxed at a rate of 125 and any. The Connecticut government does not allow any cities or municipalities to levy a sales tax.

This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under. Usually the vendor collects the sales tax from the consumer as the consumer makes. Calculator Use Sales Tax Amount Net Price x Sales Tax.

The starting revenue amounts. Private sales of vehicles other than passenger cars and light duty trucks mentioned above are charged 635 or 775 for vehicles over 50000 sales and use tax based on the purchase. Danbury is located within Fairfield County.

The average cumulative sales tax rate in Danbury Connecticut is 635. 55 for up to 100000. Your household income location filing status and number of personal.

Nearby homes similar to 3619 Comet Ct have recently sold between 465K to 530K at an average of 270 per square foot. Sales and Use Tax Information. Connecticut Income Tax Calculator 2021.

5 for up to 50000. The current sales tax in Connecticut is 635 for vehicles that are 50000 or less. This includes the rates on the state county city and special levels.

68 rows This Do-it-Yourself Tax Calculator is an online tool that allows you to calculate the approximate impact of tax changes on overall state revenue. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Connecticut Sales Tax Calculator You can use our Connecticut Sales Tax Calculator to look up sales tax rates in Connecticut by address zip code.

Social Security Benefit Adjustment Worksheet. This means that if you purchase a new vehicle in Connecticut then you will have to pay an. Find your Connecticut combined.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Sales Tax Relief for Sellers of Meals. This takes into account the rates on the state level county level city.

Property Tax Credit Calculator. In zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed. Effective tax rate.

Connecticut Sales Tax Calculator Purchase Details. 635 Average Sales Tax Summary The average cumulative sales tax rate in the state of Connecticut is 635. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Connecticut local counties cities and special taxation.

Usa Sales Tax Calculator Apps On Google Play

Connecticut To Tax Digital Products Plastic Bags And More

Sales Tax Calculator And Rate Lookup Tool Avalara

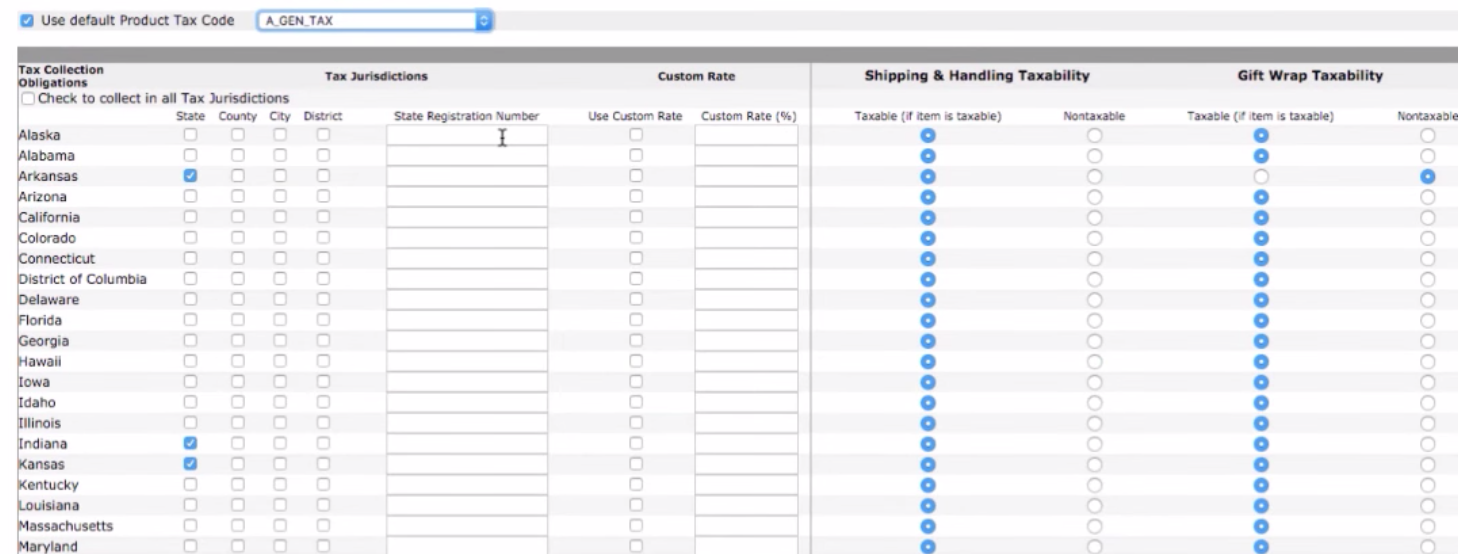

Love Yourself Beauty Online How Do I Find My Tax Rate For My Avon Business

How To Calculate California Sales Tax 11 Steps With Pictures

Victor 1100 3a 10 Digit Lcd Solar Battery Powered Compact Desktop Calculator With Antimicrobial Coating

Connecticut Property Tax Calculator 2022 Suburbs 101

Rhode Island Income Tax Calculator Smartasset

How To Calculate Cannabis Taxes At Your Dispensary

Los Angeles Sales Tax Rate And Calculator 2021 Wise

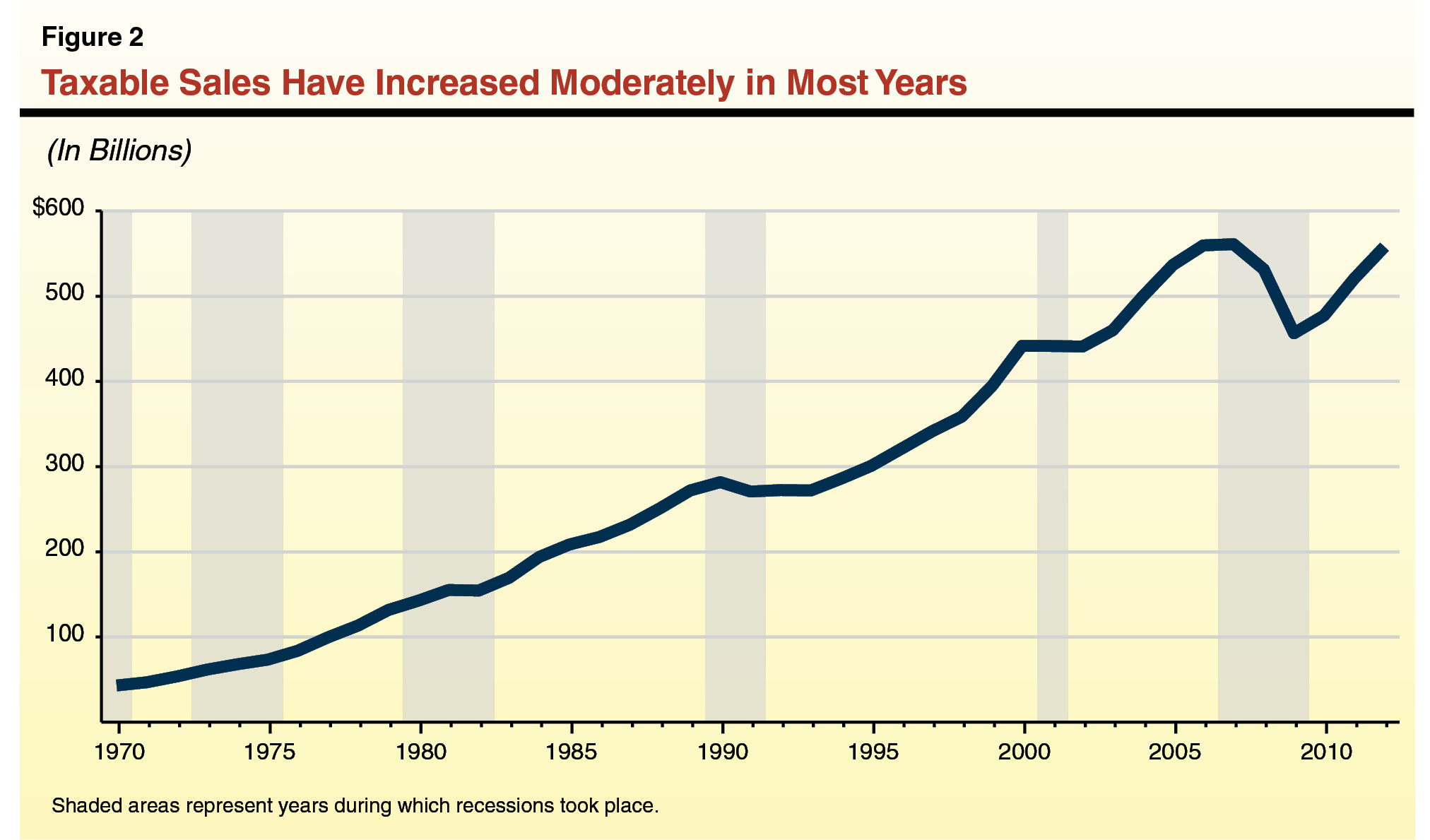

Why Have Sales Taxes Grown Slower Than The Economy

2022 Capital Gains Tax Rates By State Smartasset

Sales Tax License When You Need One And When You Don T Article

Sales Tax Calculator And Rate Lookup Tool Avalara

Large Calculator Citizen Ct 555n Ct 555 N Tax Calculator Mark Up Calculation Kalkulator Besar Dagang Citizen Ct 555n Ct 555 N Tax Calculator Mark Up Calculation Shopee Malaysia

Car Payments Calculator Car Affordability Calculator Nadaguides